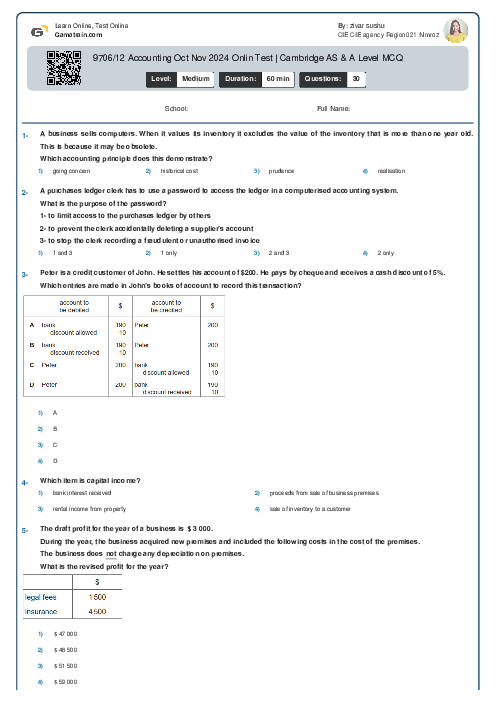

9706/12 Accounting Oct Nov 2024 Onlin Test | Cambridge AS & A Level MCQ

A business with a year-end of 31 December purchased a motor vehicle on 1 January 2015 for $24 000. The estimated useful life of the motor vehicle was four years and the estimated residual value at the end of four years was $8000.

The business depreciates motor vehicles at 25% per annum using the reducing balance method. No depreciation is charged in the year of disposal.

The motor vehicle was sold on 31 July 2018 for $12 000.

What was the profit on the sale…