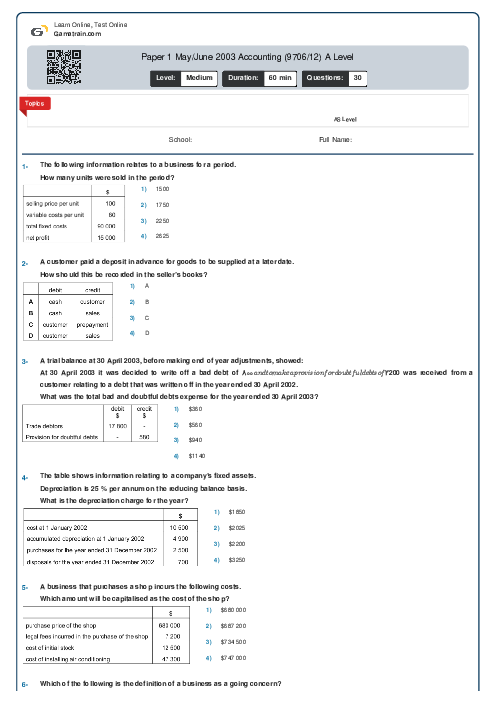

Paper 1 May/June 2003 Accounting (9706/12) A Level

Cambridge

AS & A Level

Accounting (9706)

شهریور

2003

شامل مباحث:

AS Level

تعداد سوالات: 30

سطح دشواری:

متوسط

شروع:

آزاد

پایان:

آزاد

مدت پاسخگویی:

60 دقیقه

پیش نمایش صفحه اول فایل

A bakery produces 1000 muffins a day. The total direct costs for these are shown.

An oven must be set up for each batch of 50 muffins. The cost for each oven set-up is $40. Production overheads are 20% of direct wages.

The bakery requires a profit margin of 25%.

What is the selling price of one muffin?