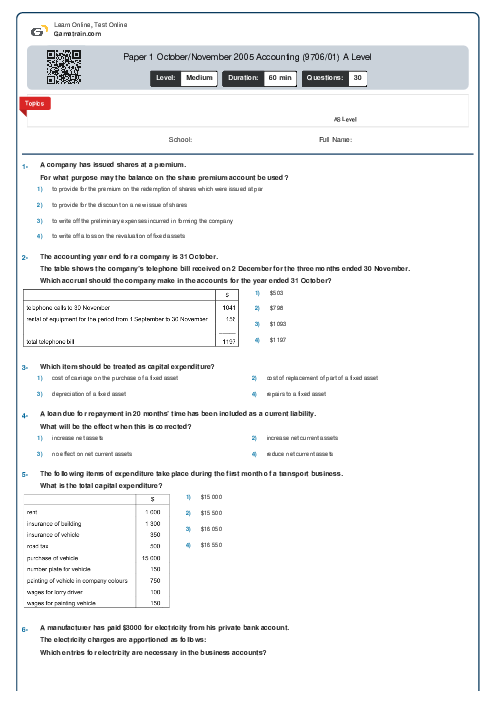

Paper 1 October/November 2005 Accounting (9706/01) A Level

Cambridge

AS & A Level

Accounting (9706)

بهمن

2005

شامل مباحث:

AS Level

تعداد سوالات: 30

سطح دشواری:

متوسط

شروع:

آزاد

پایان:

آزاد

مدت پاسخگویی:

60 دقیقه

پیش نمایش صفحه اول فایل

Which item is not included as part of the capital cost of a new machine?