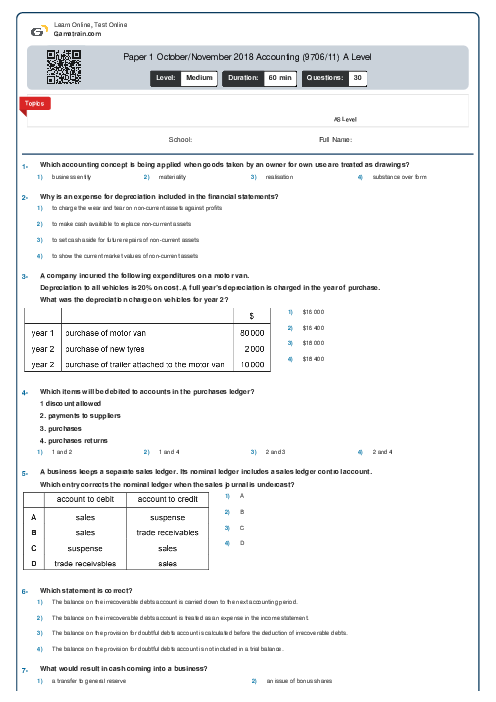

Paper 1 October/November 2018 Accounting (9706/11) A Level

The sales ledger control account of a business showed a debit balance of $\$ 26400$.

This did not agree with the total of the sales ledger balances.

The following items appeared in the sales ledger accounts but had been omitted from the sales ledger control account.

1 a contra item, $\$ 340$

2 discount allowed, $\$ 56$

3 dishonoured cheque, $\$ 62$

4 irrecoverable debt written off,…