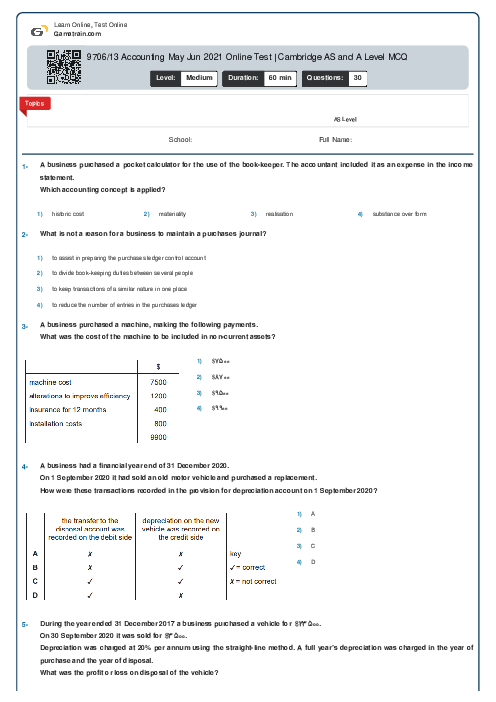

9706/13 Accounting May Jun 2021 Online Test | Cambridge AS and A Level MCQ

On 1 January 2021, W Limited had total revenue reserves of $\$ 122000$.

During the year ended 31 December 2021, the following took place.

1 A dividend of $\$ 7500$ was paid.

2 An amount of $\$ 10000$ was transferred from retained earnings to general reserve.

3 Premises were revalued upwards by $\$ 19800$.

For the year ended 31 December 2021, W Limited made a profit for the year of $\$ 32000$.