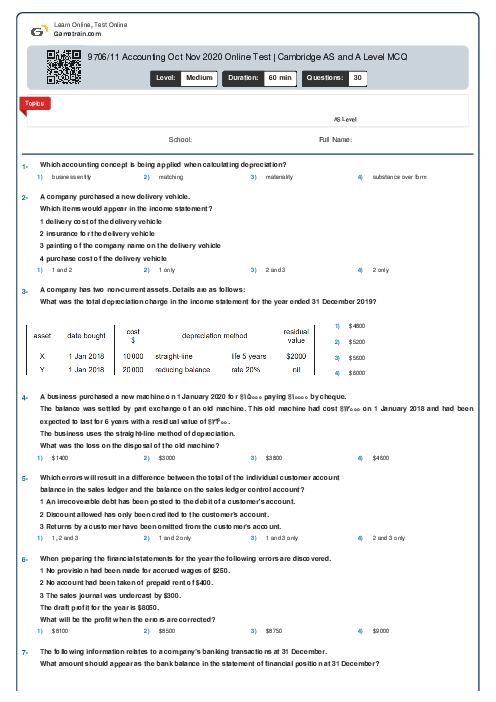

9706/11 Accounting Oct Nov 2020 Online Test | Cambridge AS and A Level MCQ

Felix drew $\$ 200$ out of his business bank account in order to top up his petty cash float.

When recording this transaction in his cash book he reversed the entries.

Despite this error the bank balance showing in his cash book was equal to the balance on his bank statement at the same date.

How was this possible?