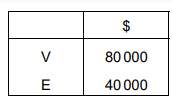

V and E are in partnership, sharing profits and losses equally.

Their capital accounts showed the following credit balances at 31 March 2021.

Z was admitted as a partner on 1 April 2021. At that date the following items were taken into account.

1 Non-current assets were revalued downwards by $\$ 20000$.

2 Goodwill was valued at $80 000, but will not remain in the books of account after Z is admitted.

The new profit-sharing ratio will be V 40%, E 30% and Z 30%.

What was the balance on E’s capital account after the admission of Z?

1 )

$\$ 30000$

$\$ 46000{\text{ }}$

3 )

$\$ 56000{\text{ }}$

4 )

$\$ 70000$

تحلیل ویدئویی تست

منتظریم اولین نفر تحلیلش کنه!