At 1 April 2019 a business had a provision for doubtful debts of $3400.

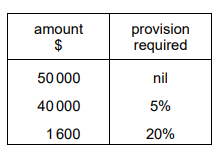

An analysis of trade receivables at 31 March 2020 was as follows.

During the year an irrecoverable debt of $3000 had been written off in the customer’s account, but no entry made in the income statement.

No entry had been made for the increase or the decrease in the provision for doubtful debts.

The income statement for the year ended 31 March 2020 showed a draft profit for the year of $90000.

What was the effect on the draft profit for the year of these omissions?

1 )

$680 overstated

2 )

$680 understated

$1920 overstated

4 )

$1920 understated

تحلیل ویدئویی تست

منتظریم اولین نفر تحلیلش کنه!