Ravi’s financial year ends on 30 April.

Ravi bought a motor vehicle for $8000 on 1 May 2020 and sold it for $4050 on 1 May 2022.

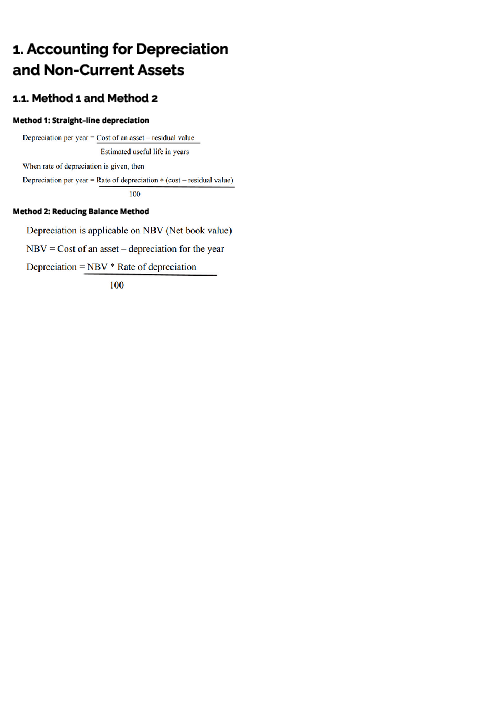

He uses the reducing balance method of depreciation at 20% per annum.

What would be recorded in the income statement for the year ended 30 April 2023 for the disposal of the motor vehicle?

1 )

$750 loss

2 )

$750 profit

$1070 loss

4 )

$1070 profit

تحلیل ویدئویی تست

منتظریم اولین نفر تحلیلش کنه!