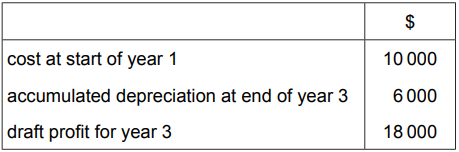

The following information relates to the non-current assets of a business that was formed three years ago.

In calculating the draft profit for year 3, depreciation has been consistently charged using the straight-line method.

Prior to finalising the accounts, the business decided to change the method of depreciation for year 3 to the reducing balance method at a rate of 25% per annum.

What was the revised profit for year 3?

1 )

$16 000

2 )

$17 500

$18 500

4 )

$19 000

تحلیل ویدئویی تست

منتظریم اولین نفر تحلیلش کنه!