Accounting 9706/03 Oct Nov 2003

1. Discount rate in NPV calculation: Rate used for discounting future cash flows in capital expenditure decisions and its impact on net present value (NPV).

2. Cash flow statement exclusions and capital redemption reserves: Items not included in cash flow statements, reasons for creating a capital redemption reserve during share redemption, and its role in protecting creditors' rights.

3. Share capital and profit retention: Calculation of profit and loss account balance post-redeemable preference shares redemption, impact on distributable profits, and effects of share consolidation on shareholder equity.

4. Acquisition financing and gearing ratio: Issuance of debentures for business acquisition, analysis of resulting gearing, and implications on company's financial leverage.

5. Goodwill and acquisition costs: Calculation of goodwill in business acquisition, valuation of shares and loan stock issued as consideration, and implications on financial statements.

6. Profit and efficiency variances: Calculation of variances in materials and labour costs, evaluation of production efficiency, and analysis of variances on overall profitability.

7. Cash flow and liquidity management: Calculation of cash received from sales, preparation of master budget, and impact of changes in debtor days on budgeted cash inflows.

8. Investment appraisal methods: Use of accounting rate of return (ARR), internal rate of return (IRR), and net present value (NPV) in evaluating capital investment projects, and advantages/disadvantages of each method in decision-making.

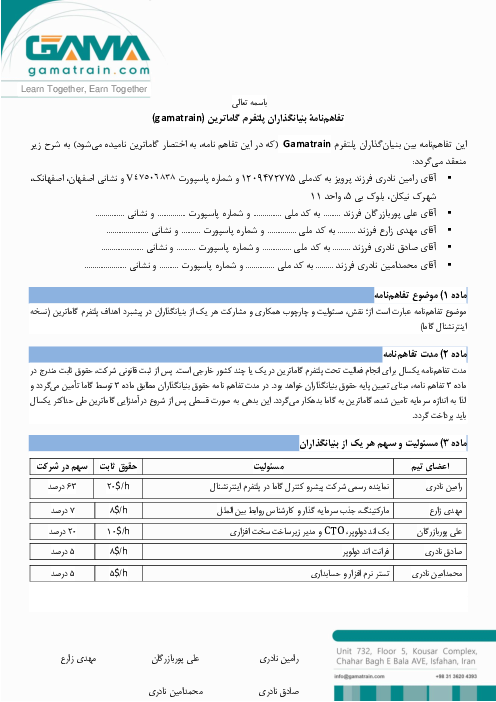

باز نشر محتواها در فضای مجازی، ممنوع است.