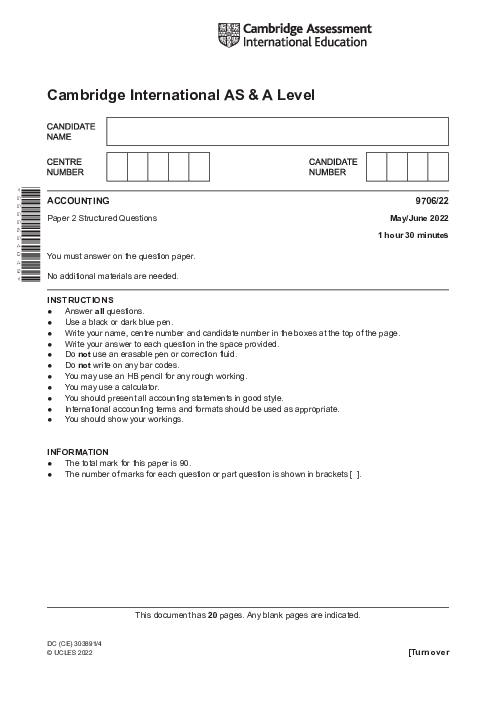

Accounting 9706/22 May June 2019

1. Income statement preparation and financial adjustments: Lee's income statement, adjustments for unrecorded invoices, inventory valuation, sale or return transactions, and irrecoverable debts.

2. Financial position and current assets/liabilities: Calculation of current assets and liabilities for Lee’s statement of financial position, including trade receivables, trade payables, and provision adjustments.

3. Sole trader benefits and drawbacks: Analysis of advantages and disadvantages of operating as a sole trader, such as business control and liability exposure.

4. Business structure choice and capital contributions: Comparison of forming a limited company versus a partnership for Lee and Marvin, including capital contribution and profit-sharing implications.

5. Provision for doubtful debts and trade receivables analysis: Calculation of doubtful debts provision, journal entries for irrecoverable debts, and impact on profit for Sofia.

6. Inventory management and costing methods: FIFO inventory valuation for Jessie, advantages of FIFO, and overhead cost apportionment for production and service cost centers.

7. Costing and pricing strategies: Overhead absorption rate calculation, pricing for customer orders, and decision-making on accepting discounted offers for Jessie’s product.

باز نشر محتواها در فضای مجازی، ممنوع است.