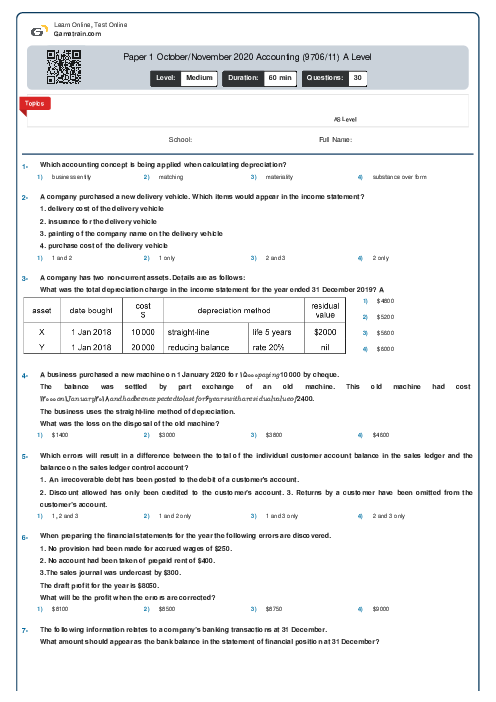

Paper 1 October/November 2020 Accounting (9706/11) A Level

Cambridge

AS & A Level

Accounting (9706)

بهمن

2020

شامل مباحث:

AS Level

تعداد سوالات: 30

سطح دشواری:

متوسط

شروع:

آزاد

پایان:

آزاد

مدت پاسخگویی:

60 دقیقه

پیش نمایش صفحه اول فایل

A business provided the following information regarding its first year of trading.

The net trade receivables recorded in the statement of financial position at the end of the year were $\$ 16660$.

What was the balance on the provision for doubtful debts account at the end of the year?