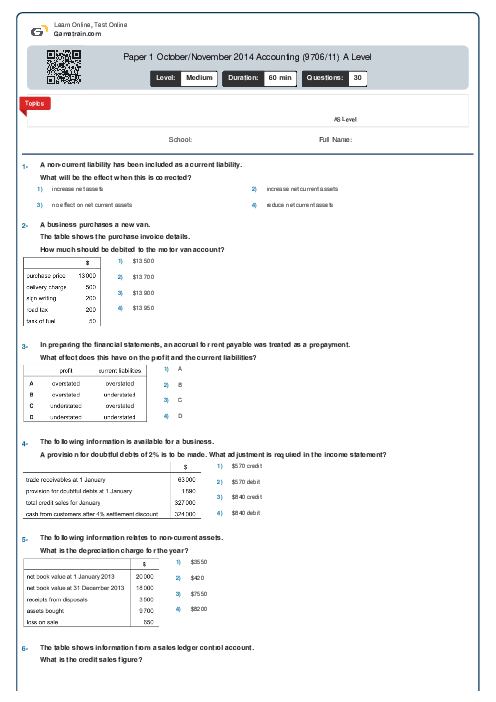

Paper 1 October/November 2014 Accounting (9706/11) A Level

Cambridge

AS & A Level

Accounting (9706)

بهمن

2014

شامل مباحث:

AS Level

تعداد سوالات: 30

سطح دشواری:

متوسط

شروع:

آزاد

پایان:

آزاد

مدت پاسخگویی:

60 دقیقه

پیش نمایش صفحه اول فایل

The following information relates to one accounting period.

What was the overhead absorption rate per unit during the accounting period?