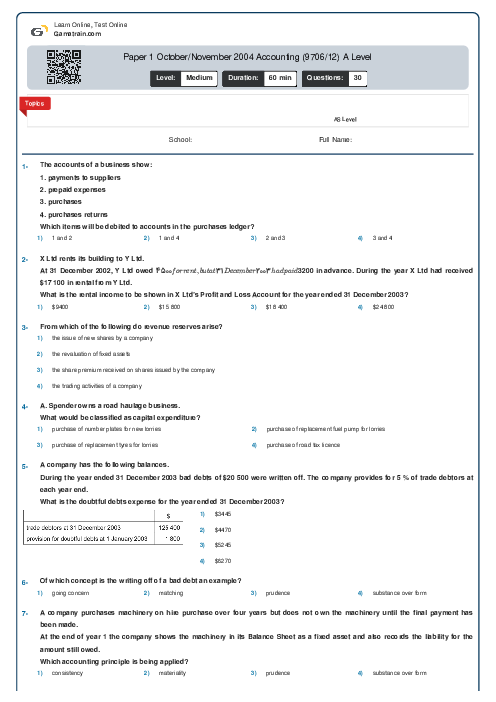

Paper 1 October/November 2004 Accounting (9706/12) A Level

Cambridge

AS & A Level

Accounting (9706)

بهمن

2004

شامل مباحث:

AS Level

تعداد سوالات: 30

سطح دشواری:

متوسط

شروع:

آزاد

پایان:

آزاد

مدت پاسخگویی:

60 دقیقه

پیش نمایش صفحه اول فایل

A business absorbs its overheads on the basis of direct labour hours.

The following information is provided for its last period.

By how much were overheads over-absorbed or under-absorbed?