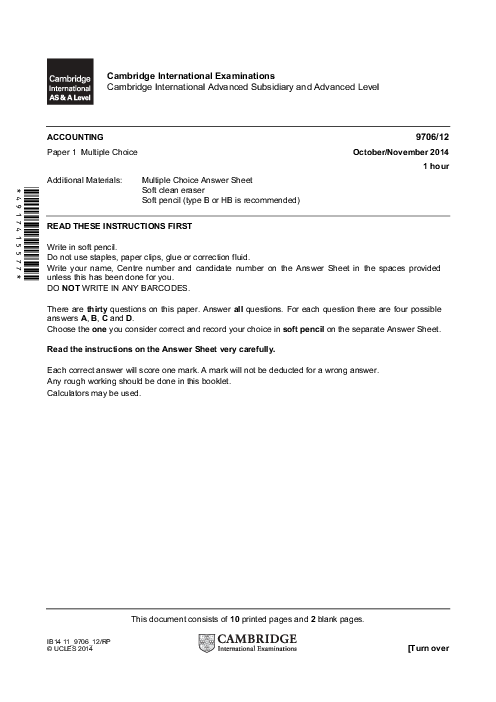

Accounting 9706/02 May June 2005 | Cambridge AS Level Past Papers With Mark Scheme

1. Partnership expansion and profit distribution: Calculation of partner profits under borrowing and partnership expansion options, including interest, manager's salary, and profit-sharing ratios for John, Georgina, Paul, and Ringo.

2. Balance sheet preparation and financial adjustments: Compilation of James Defirst Ltd’s balance sheet, application of depreciation on motor vehicles and equipment, creation of doubtful debts provision, and adjustments for sale or return stock transactions.

3. Working capital and liquidity analysis: Calculation of working capital (current) ratio and liquid (acid test) ratio for James Defirst Ltd, assessing liquidity and short-term financial health.

4. Appropriation account functions: Explanation of the purpose of the appropriation account in partnerships and limited companies, detailing profit allocation and dividend distribution processes.

5. Marginal costing and profitability analysis: Preparation of a marginal costing statement for Quango Ltd’s products, including contribution and profitability calculations, and analysis of product cost structure.

6. Profit maximization and fixed overhead adjustments: Development of a production plan to maximize profit considering increased fixed overheads, and preparation of an adjusted marginal costing profitability statement for optimal production mix.

باز نشر محتواها در فضای مجازی، ممنوع است.