Accounting 9706/21 Oct Nov 2015 | Cambridge AS Level Past Papers With Mark Scheme

1. Preparation of the refreshments trading account and income and expenditure account for a club, including depreciation and adjustments for subscriptions.

2. Calculation of partnership appropriation and current accounts, incorporating interest on loans, capital, and drawings, as well as salary allocations and profit sharing.

3. Reallocation of budgeted overheads and calculation of absorption rates in production departments based on activity levels such as machine hours and direct labor hours.

4. Determination of total job costs and selling price based on a given profit margin, emphasizing prime cost and overhead absorption.

5. Explanation of overhead over absorption and under absorption with specific examples from department cost variances and actual versus estimated figures.

6. Error corrections in accounting records, including adjustments for sales day book, closing inventory, repair misclassifications, and purchase invoice discrepancies.

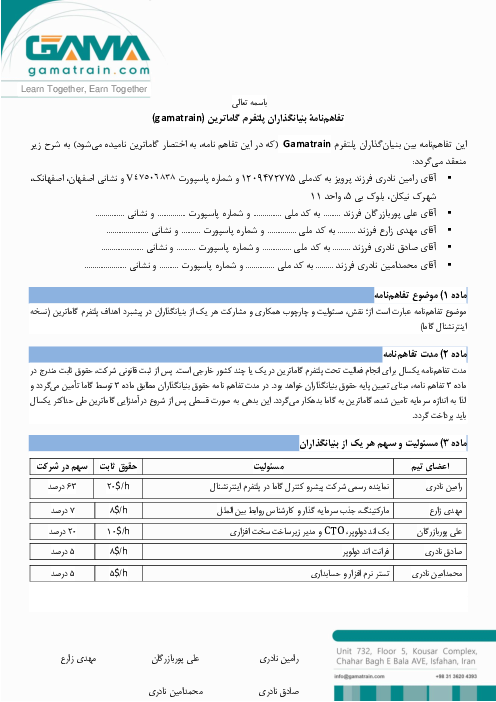

باز نشر محتواها در فضای مجازی، ممنوع است.