Accounting 9706/12 Oct Nov 2017

1. Revenue and capital expenditure: Classification of expenditure related to machinery installation, office redecoration, and purchase of motor vehicle components.

2. Depreciation and asset revaluation: Purpose of depreciation, calculation of revaluation reserve, and impact of depreciation methods on asset disposal losses.

3. Financial controls and sales ledger: Importance of sales ledger control accounts in fraud prevention, financial statement preparation, and doubtful debt identification.

4. Partnership changes and capital accounts: Calculation of capital account adjustments in response to changes in profit-sharing ratios, partner retirement, and goodwill valuation.

5. Cost behavior and break-even analysis: Calculation of break-even units, margin of safety, and identification of fixed, variable, and semi-variable costs in business operations.

6. Investment appraisal and profit maximization: Comparison of marginal costing versus absorption costing profits, calculation of overhead recovery, and evaluation of planning in business operations.

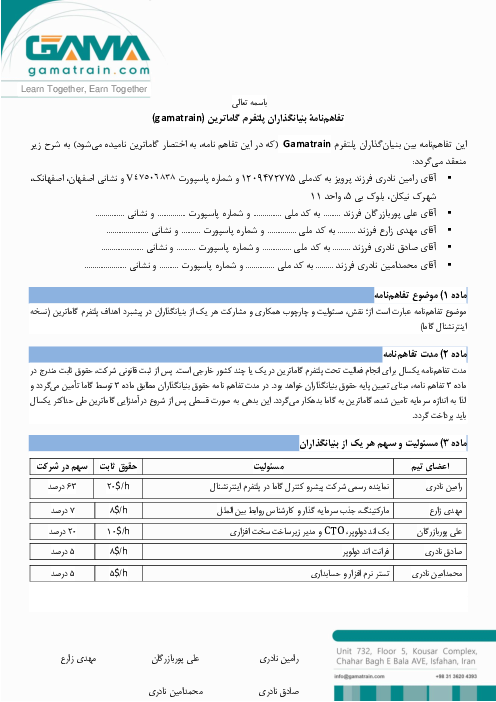

باز نشر محتواها در فضای مجازی، ممنوع است.