Accounting 9706/22 Oct Nov 2010 | Cambridge AS Level Past Papers With Mark Scheme

1. Calculation of total sales and purchases for sole traders using bank receipts, trade receivables, and cash transactions.

2. Income statement preparation for sole traders, including adjustments for goods withdrawn for personal use and provision for depreciation.

3. Balance sheet construction for sole traders, incorporating prepaid expenses, accrued wages, and capital adjustments.

4. Subscription accounting for clubs, managing arrears, prepayments, and bad debts write-offs.

5. Café trading account preparation, adjusting for inventory and expenses to determine gross profit.

6. Break-even analysis for manufacturing, incorporating fixed costs, variable costs, and contribution per unit to evaluate product profitability and potential expansion.

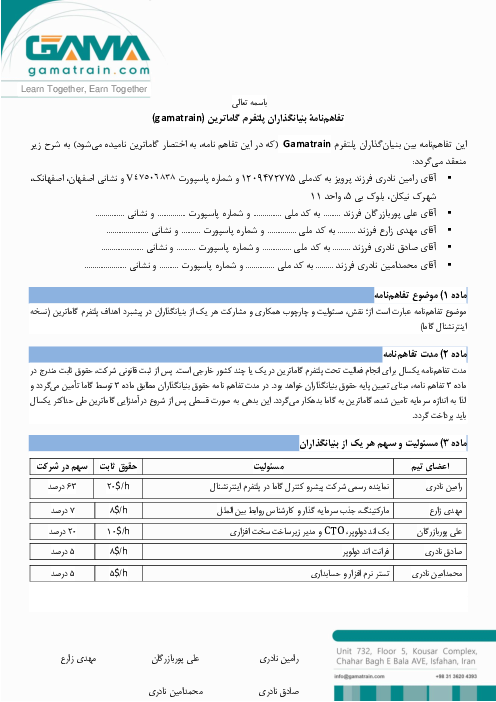

باز نشر محتواها در فضای مجازی، ممنوع است.